The Ultimate Resource for hard money lenders in Atlanta Georgia

Wiki Article

Why a Hard Money Funding May Be the Right Selection for Your Next Investment

Get in tough money car loans, a device that focuses on swift approval and funding, as well as the building's worth over a consumer's credit history. Despite their potential high prices, these finances might be the trick to unlocking your following profitable deal.

Recognizing the Fundamentals of Tough Money Loans

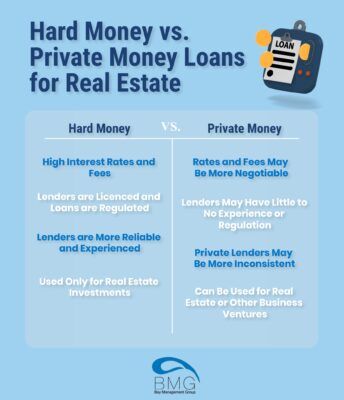

While traditional lendings might be acquainted to most, understanding the basics of tough cash finances is essential for prospective financiers. Tough cash loans are a kind of short-term financing where the investor safeguards the Financing with actual estate building as security. Lenders are generally exclusive business or people, making the Funding terms and rates more versatile than traditional financial institution fundings.The Advantages of Choosing Tough Cash Car Loans

Potential Drawbacks of Difficult Money Financings

In spite of the benefits, there are likewise possible drawbacks to consider when taking care of hard money loans. One of the most significant is the high rates of interest. Since hard money lending institutions tackle even more risk with these fundings, they typically call for greater returns. This can indicate rate of interest that are much greater than those of standard financings (hard money lenders in atlanta georgia). An additional downside is the short Lending term. Tough cash car loans are commonly short-term lendings, generally around year. This can tax the borrower to settle the Lending promptly. Finally, these car loans likewise have high fees and closing expenses. Debtors might have to pay a number of factors ahead of time, which can include substantially to the total cost of the Finance. These aspects can make tough cash car loans much less eye-catching for some investors.Real-Life Situations: When Hard Cash Finances Make Good Sense

Where might hard cash financings be the suitable financial remedy? They often make feeling in situations where people or companies need quick accessibility to capital. Actual estate capitalists looking to seize a time-sensitive opportunity might not have the luxury to wait for conventional financial institution loans. Hard money loan providers, with their faster authorization and dispensation procedures, can be the trick to safeguarding the residential property.

Another circumstance is when an investor intends to remodel a residential property before marketing it. Here, the tough money Loan can fund the improvement, enhancing the home's worth. The Funding is after that paid off when the property is offered. Thus, in real-life situations where speed and adaptability are important, difficult cash financings can be the optimal option.

Tips for Browsing Your First Hard Cash Finance

Exactly how does one efficiently browse their first tough go to my site money Loan? The procedure might seem overwhelming, however with mindful preparation and understanding, it can become a useful device for financial investment. Research is critical. Know the specifics of the Finance, consisting of passion prices, payment terms, and feasible charges. Determine a reliable lending institution. Search for transparency, professionalism and trust, and a strong record. Third, make sure the investment residential property has prospective earnings enough to generate and cover the Funding revenue. Lastly, have a departure method. Hard money car loans are temporary, usually 12 view months. Understanding just how to pay it off-- whether through offering the building or various other refinancing options-- reduces danger and maximizes gains.Verdict

To conclude, tough money fundings offer a fast, flexible financing choice genuine estate financiers wanting to profit from time-sensitive possibilities. In spite of prospective downsides like higher passion rates, their simplicity of gain access to and emphasis on home worth over creditworthiness make them an eye-catching choice. With cautious factor to consider and sound investment techniques, tough cash fundings can be an effective tool for optimizing returns on temporary projects.While conventional finances might be acquainted to most, recognizing the essentials of hard cash lendings is important for potential financiers. Tough cash financings are a kind of temporary financing where the financier protects the Financing with actual estate building as security. Lenders are normally personal companies or people, making the Financing terms and prices more adaptable than typical financial institution finances. Unlike standard bank lendings, tough money lending institutions are primarily worried with the value of the property and its prospective return on investment, making the authorization procedure less rigorous. Hard cash car loans are typically short-term financings, normally around 12 Website months.

Report this wiki page